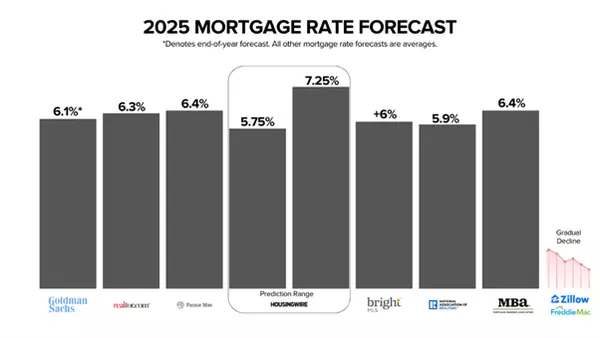

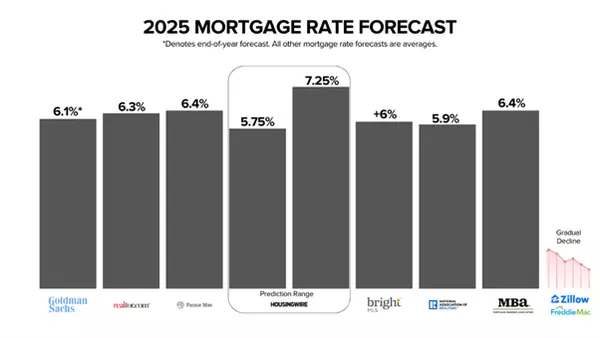

2025 Mortgage Rate Forecast

Mortgage rates just dropped to 6.74%—the lowest in 4 months! Buyers, this is your window of opportunity. Lower rates mean more buying power, and if forecasts hold, we could see mid-5% rates by the end of 2025. But will we? Some experts see rates staying around 6% Others predict a slow decline into

Read More

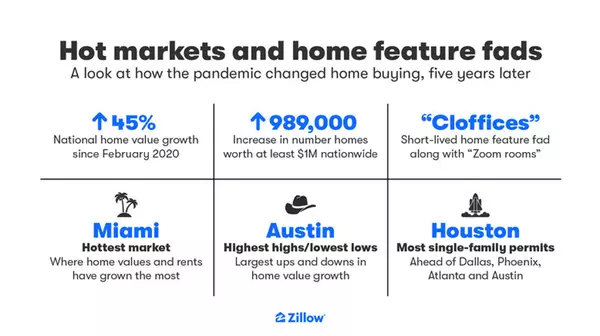

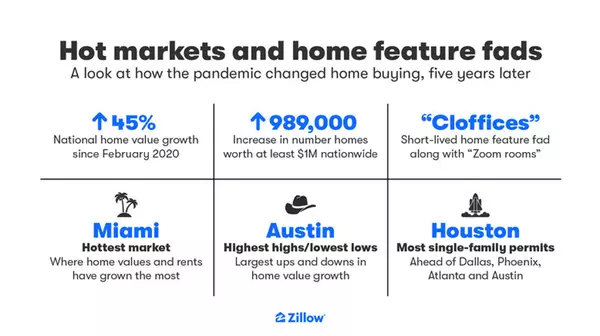

Hot markets and home feature fads

45% home price appreciation in just 5 years?! That’s a decade’s worth of growth in a flash. We all know ultra-low interest rates fueled this—but here’s the real question: What happens next? Some say home prices will slow but still rise. Others think affordability issues could lead to a market shi

Read More

Home Equity on the Rise—Every Quarter Since 2012!

Home Equity on the Rise—Every Quarter Since 2012! 📈🏡 The latest FHFA House Price Index confirms what homeowners across the country have experienced firsthand—home values have increased every single quarter since early 2012! 🙌 ✅ In Q4 2024, U.S. home prices rose 4.5% from the previous year and

Read More

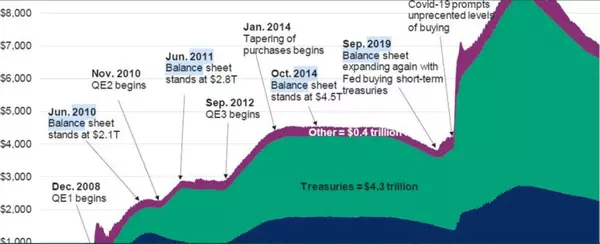

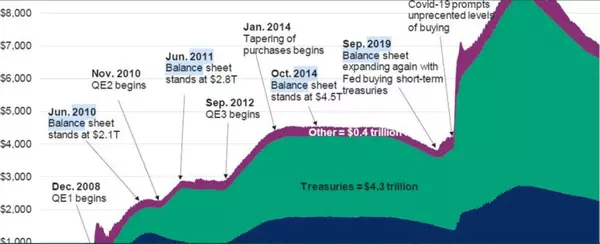

Mortgage-Backed Securities

In the past, government interventions, such as the Federal Reserve's purchase of mortgage-backed securities, artificially boosted housing demand by lowering interest rates and making financing more accessible. This led to increased home purchases and rising prices. Today, while demand for housi

Read More

Categories

Recent Posts