Mortgage-Backed Securities

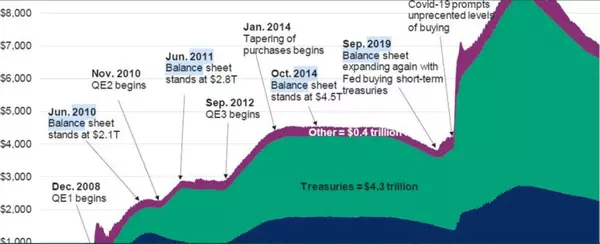

In the past, government interventions, such as the Federal Reserve's purchase of mortgage-backed securities, artificially boosted housing demand by lowering interest rates and making financing more accessible. This led to increased home purchases and rising prices.

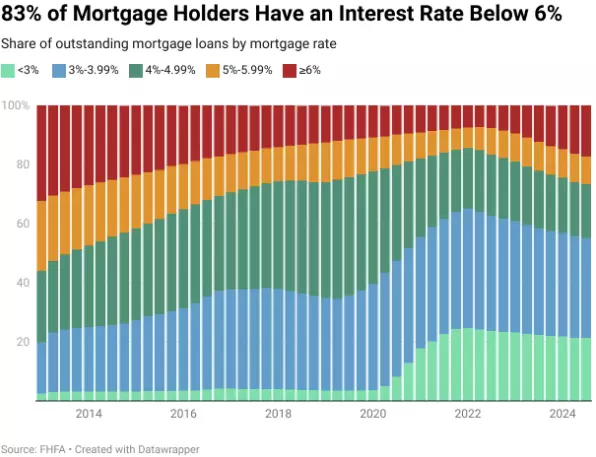

Today, while demand for housing remains, affordability challenges are causing many buyers to hesitate. Elevated mortgage rates above 6% are likely to maintain affordability challenges and the lock-in effect, limiting sales recovery.

Categories

Recent Posts

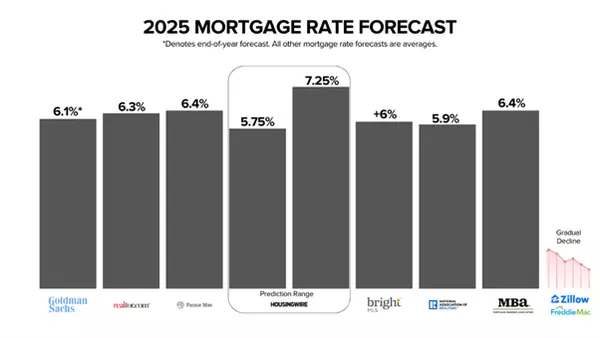

2025 Mortgage Rate Forecast

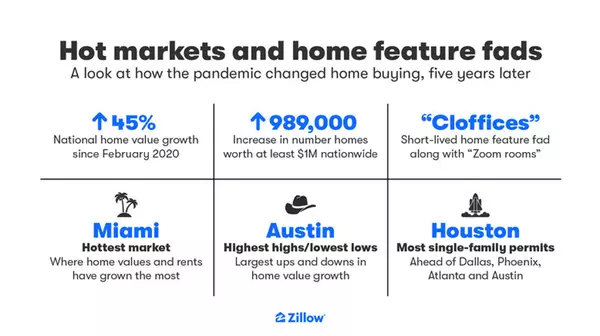

Hot markets and home feature fads

Home Equity on the Rise—Every Quarter Since 2012!

Mortgage-Backed Securities

Top 100 Expensive Markets:

The Lock-In Effect: Why Housing Inventory is So Tight

From Renter to Homeowner: The 5 Biggest Lifestyle Shifts You’ll Make

How Buyers are Adapting in Today’s Housing Market

Lower Rates, More Options: Fall Opportunities for Buyers

State Farm Pulls Out of New Applications in California

GET MORE INFORMATION

Kalani Stone

Agent | Lic# CalBRE: 01336392