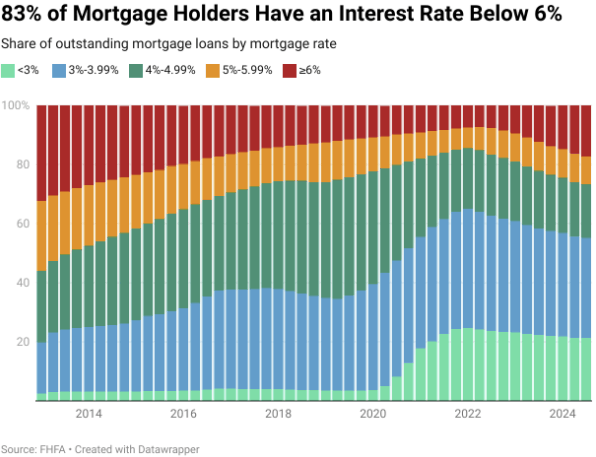

The Lock-In Effect: Why Housing Inventory is So Tight

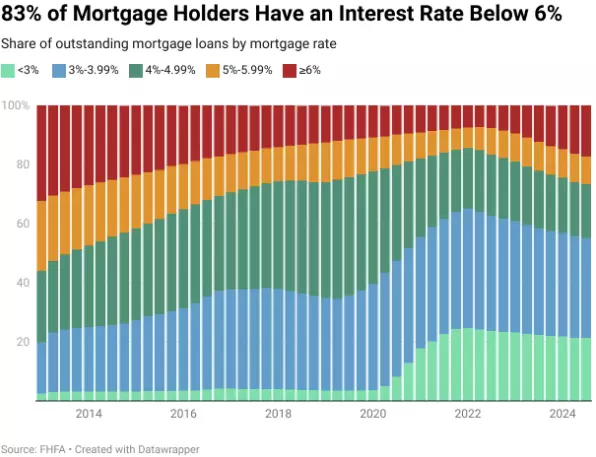

A surprising 40% of homeowners nationwide don’t have a mortgage at all—and of those who do, only 1 in 4 has an interest rate above 5% (as this chart shows). With so many homeowners locked into ultra-low rates, it's no wonder we're seeing such low inventory on the market.

Homeowners with rates under 5% are hesitant to sell, keeping inventory tight.

This means fewer options for buyers and more competition for the homes that do hit the market.

Until rates shift or life circumstances change, many homeowners are choosing to stay put.

Does this surprise you? Where do you fall in these categories? Are you holding onto a low rate, or are you searching for a home in today’s market?

Categories

Recent Posts

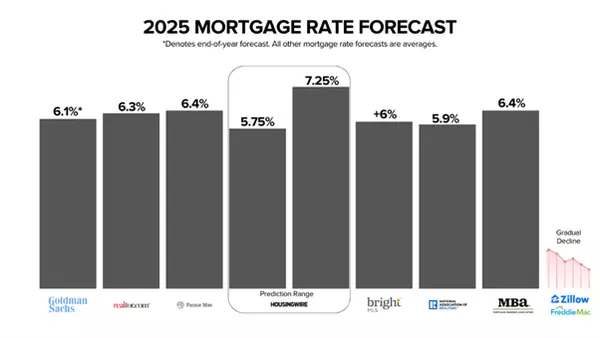

2025 Mortgage Rate Forecast

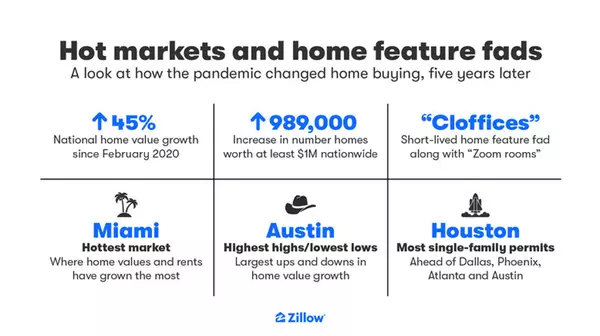

Hot markets and home feature fads

Home Equity on the Rise—Every Quarter Since 2012!

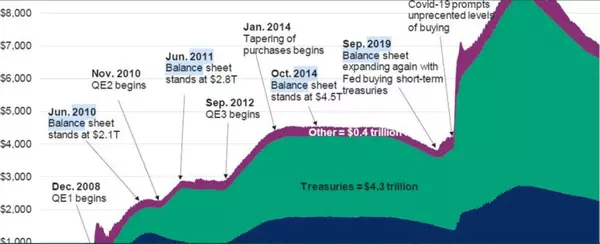

Mortgage-Backed Securities

Top 100 Expensive Markets:

The Lock-In Effect: Why Housing Inventory is So Tight

From Renter to Homeowner: The 5 Biggest Lifestyle Shifts You’ll Make

How Buyers are Adapting in Today’s Housing Market

Lower Rates, More Options: Fall Opportunities for Buyers

State Farm Pulls Out of New Applications in California

GET MORE INFORMATION

Kalani Stone

Agent | Lic# CalBRE: 01336392