From Renter to Homeowner: The 5 Biggest Lifestyle Shifts You’ll Make

Becoming a homeowner is an exciting milestone—a dream for many that brings freedom, responsibility, and an entirely new way of living. While it offers incredible opportunities, homeownership is a lifestyle shift that goes far beyond no longer paying rent. Understanding these changes can help you transition smoothly and make the most of this exciting new chapter.

1. Wealth-Building Equity Homeownership transforms your monthly payment from an expense into an investment. Unlike rent, which doesn’t offer long-term returns, mortgage payments build equity—the portion of your home that you truly own. Over time, equity grows as you pay down your mortgage and your property appreciates in value.

Fact: According to NAR Chief Economist Lawrence Yun, homeowners’ net worth is, on average, 40 times that of renters. This is due to the combination of equity and property appreciation. As Yun explains, “Homeowners’ wealth steadily rises while renters’ wealth does not. The sooner you enter the housing market, the sooner you accumulate wealth.”

Pro Tip: Think of your mortgage as an investment in your financial future. While homeownership comes with costs, it also creates opportunities for long-term wealth and stability.

2. Maintenance: The Buck Stops with You When you own a home, there’s no landlord to call for repairs. From plumbing issues to landscaping, all maintenance responsibilities fall squarely on your shoulders. This newfound autonomy is empowering, but it also requires planning and preparation.

Fact: The 2023 HomeAdvisor survey shows that homeowners spend an average of $3,192 annually on maintenance and repairs.

Pro Tip: Create a dedicated emergency fund for home repairs. Experts recommend setting aside 1–3% of your home’s value annually for unexpected expenses, giving you peace of mind when surprises arise.

3. Customization: Your Space, Your Rules Homeownership brings unparalleled freedom to make your space truly your own. No more asking permission to paint walls or swap out light fixtures. Now, you can create a home that reflects your style, needs, and personality.

Pro Tip: Before diving into major renovations, live in your home for a while. Understanding how you use the space ensures your updates align with your daily lifestyle and long-term goals.

4. Community Involvement: Becoming a Stakeholder Owning a home often deepens your connection to the community. You may feel more invested in neighborhood events, local governance, and even home values. This stake in your community encourages active participation in shaping its future.

Pro Tip: Join neighborhood groups, attend homeowner association meetings, or volunteer locally. Not only will you stay informed, but you’ll also build meaningful connections with your neighbors.

5. Predictable Payments: Locked-in Shelter Costs With homeownership comes stability. Unlike renting, where lease renewals often bring unpredictable increases, a fixed-rate mortgage ensures your principal and interest payments remain steady over time. This stability allows you to plan your finances with confidence.

Pro Tip: While your monthly payment may be consistent, don’t forget to budget for property taxes, insurance, and maintenance, which can vary. These costs are part of protecting your investment and ensuring your home stays in top condition.

Final Thoughts Homeownership is a transformative journey that brings freedom, responsibility, and longterm benefits. By embracing these lifestyle shifts and planning ahead, you’ll be well-prepared to thrive in your new role as a homeowner. It’s not just about buying a house—it’s about building a home and a future.

Ready to make the leap? Let’s talk about how to find the right home for you.

Categories

Recent Posts

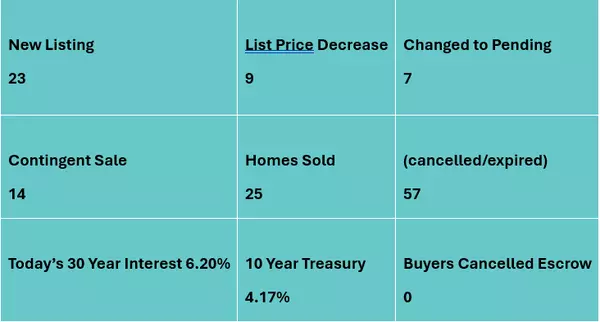

Santa Cruz County Market Update

Santa Cruz Tide Report

Housing Market 2026

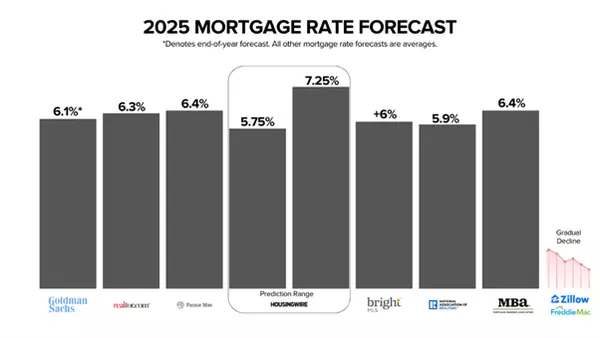

2025 Mortgage Rate Forecast

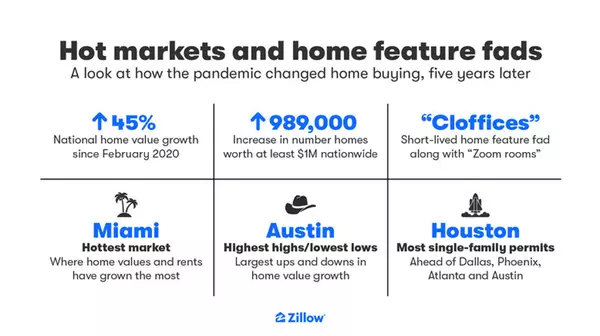

Hot markets and home feature fads

Home Equity on the Rise—Every Quarter Since 2012!

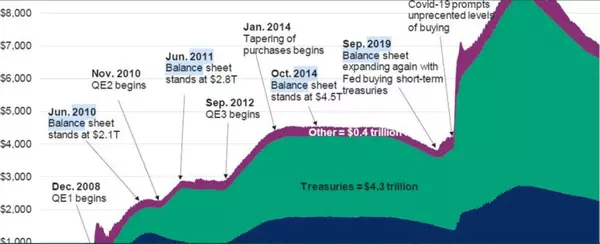

Mortgage-Backed Securities

Top 100 Expensive Markets:

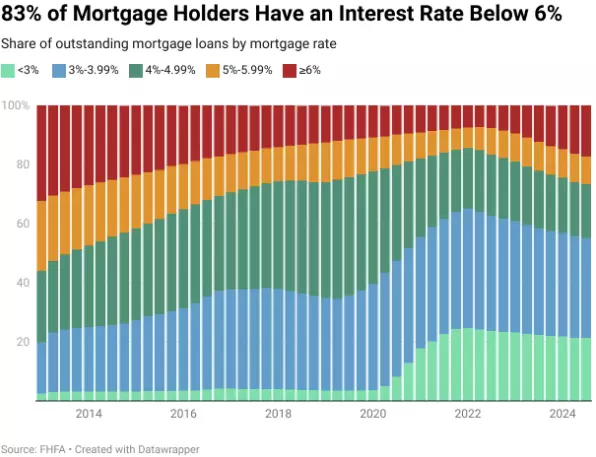

The Lock-In Effect: Why Housing Inventory is So Tight

From Renter to Homeowner: The 5 Biggest Lifestyle Shifts You’ll Make

GET MORE INFORMATION

Kalani Stone

Agent | Lic# CalBRE: 01336392